Avoiding IRMAA Surcharges on Your Medicare Premiums

Sep 18 2025 | Back to Blog List

When people retire, they expect their monthly costs to become more predictable. That’s why Medicare’s Income-Related Monthly Adjustment Amount (IRMAA) can be so frustrating.

We’ve heard the story many times:

We’ve heard the story many times:

“I was used to paying about $185 a month for Medicare Part B, and suddenly I get a letter from Social Security saying my premium is going to be $600 per month. What happened?”

What happened was IRMAA. It’s not a penalty or a bug in the system; it’s simply how Medicare premiums are structured for higher-income retirees. But because IRMAA is based on your income from two years earlier, it often sneaks up on people. A decision you made in 2024, like selling a vacation home or converting an IRA, may not show up in your premiums until 2026.

The good news? With proactive tax and retirement planning, you can often reduce or avoid IRMAA.

What is IRMAA?

IRMAA is short for Income-Related Monthly Adjustment Amount. It is essentially a surcharge layered on top of your standard Medicare premiums. It applies to those with Part B, which covers outpatient care, and Part D, which covers prescriptions. Many retirees never encounter it, but for those with higher incomes, IRMAA can significantly increase your monthly costs in retirement—just when you were expecting them to steady.

IRMAA is a surprise for many retirees because it’s based on your income from two years ago, not today. That means a decision you made in 2023—for example, selling an investment property, realizing a large capital gain, or completing a Roth conversion—could come back in 2025 in the form of higher Medicare premiums.

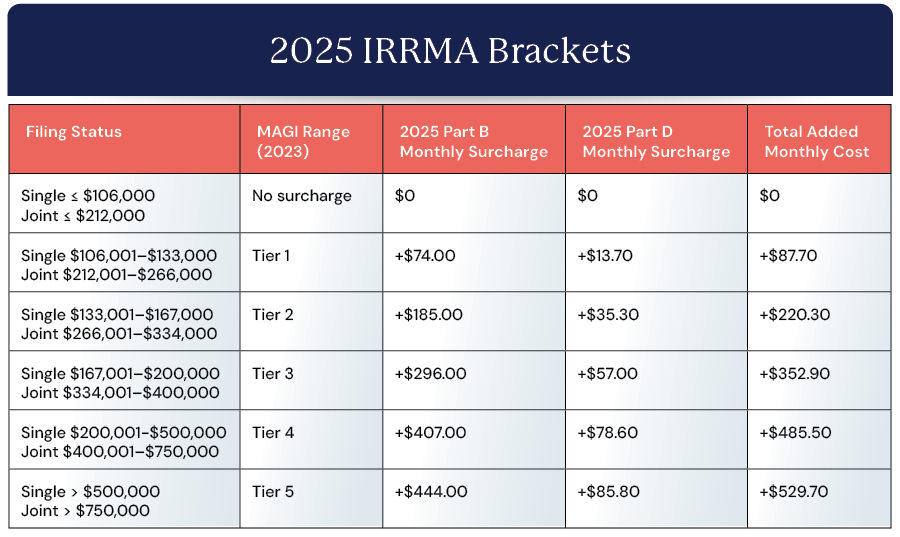

IRMAA also operates on a tiered system with steep "cliffs." Crossing a bracket threshold by as little as one dollar can trigger a significantly higher monthly premium for the entire year. The Modified Adjusted Gross Income (MAGI) calculation for IRMAA takes your Adjusted Gross Income (AGI) and adds your tax-exempt interest, so those municipal bonds you invested in to avoid taxation can still have other impacts.

This makes strategic income planning crucial, especially for those whose MAGI is close to a bracket's upper limit.

The 2025 adjustment brackets (based on 2023 MAGI) look like this:

What does this look like in practice? Take Jack and Jill, a retired couple filing jointly. Their typical retirement income—pensions, Social Security, and modest IRA withdrawals—totals about $210,000 per year.

In 2023, they sold a piece of land they had owned for years, realizing a $190,001 capital gain. Their income for that year jumped to $400,001.

Prior to 2023, the couple had stayed just under the IRMAA MAGI threshold of $212,000, so they paid the standard Medicare premiums. When 2025’s IRMAA was calculated, it referenced 2023’s MAGI of $400,001, pushing them into Tier 4 of IRMAA. The impact? In 2025, the couple’s premiums jumped $485.50 each per month, for a total of $971 additional per month for the couple—that’s $11,652 a year!

Strategies to Sidestep IRMAA

For high-income retirees, avoiding IRMAA isn’t about eliminating it entirely—it’s about managing when and how often you pay it. With careful planning, you can reduce the number of years you’re subject to surcharges and potentially save tens of thousands in Medicare costs over your lifetime.

Some of the management strategies we can bring to bear include:

1. Strategic Roth Conversions (Before 63)

One of the most effective long-term strategies for reducing IRMAA exposure is to shrink your future required minimum distributions (RMDs). Large traditional IRAs can drive up taxable income once withdrawals begin, but Roth IRAs don’t have RMDs, and withdrawals generally don’t count toward MAGI.

By converting portions of a traditional IRA to a Roth IRA in your 50s or early 60s, you can get ahead of the two-year Medicare lookback. The key is to spread conversions across several years so you don’t unintentionally bump yourself into a higher tax bracket or IRMAA tier in the process. For high earners, this often means coordinating conversions with low-income years or pairing them with deductions to soften the tax impact.

2. Qualified Charitable Distributions (QCDs)

For retirees who are charitably inclined, QCDs offer a powerful way to help meet philanthropic goals while keeping Medicare premiums under control. Once you reach age 70½, you can transfer up to $108,000 (2025 limit) directly from your IRA to a qualified charity each year. The gift counts toward your RMD but does not increase your adjusted gross income. That means your MAGI stays lower and you avoid being pushed into a higher IRMAA tier.

3. Timing Income Events

IRMAA planning often comes down to timing. One-time events like selling a business, liquidating a real estate investment, or selling stock at a large gain can push your MAGI up multiple IRMAA tiers. A single transaction could easily increase annual Medicare premiums by thousands of dollars.

With foresight, spreading a sale across multiple tax years or pairing the event with deductions can help minimize the impact. Without planning, retirees often learn about IRMAA the hard way.

4. Harvest Losses to Offset Gains

Tax-loss harvesting isn’t just a year-end exercise—it can be a key tool in IRMAA planning. By selling securities at a loss, you can offset realized capital gains in taxable accounts, reducing your MAGI and potentially keeping you under an IRMAA threshold.

High-income investors often have large, diversified portfolios where both gains and losses exist at the same time. Proactively managing those positions throughout the year, rather than waiting until December, can help smooth out income spikes that might otherwise trigger higher premiums. Coordinating tax-loss harvesting with charitable giving or Roth conversions could make the strategy even more effective. Learn more about tax loss harvesting in this insights column.

5. Maximize Pre-Tax Contributions (If Still Working)

Not everyone enrolls in Medicare fully retired. For high earners still in the workforce at 65 or later, pre-tax contributions remain a simple but powerful lever. Maxing out Pre-Tax 401(k) deferrals, traditional IRA contributions, and Health Savings Accounts (HSAs) lowers the MAGI that will be used to calculate IRMAA two years later. For late-career professionals, this is one of the best ways to manage Medicare costs while still building wealth.

Why Medicare Planning Matters

For those impacted by IRMAA, the extra cost can be significant. What makes it tricky is the lag between the financial event that triggers IRMAA and when the higher premiums actually show up.

For high-net-worth families, avoiding unnecessary surcharges comes down to integrating Medicare planning into your broader wealth strategy. Tax planning, charitable giving, investment management, and retirement income planning all play a role.

At Cedar Point Capital Partners, we work with clients to anticipate these inflection points, build tax-aware strategies, and help ensure that Medicare premium surprises don’t derail an otherwise well-constructed retirement plan. Reach out and let’s start a conversation about your goals.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.