Capital Insights: Bonds Are Acting Like Bonds Again

Jan 21 2026 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I’m Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to 2026 and a new year of Capital Insights.

This month, we’re looking at an encouraging shift in the bond market and exploring what it means for your portfolio.

For much of the past five years, bonds haven’t behaved the way investors had come to expect. Instead of providing stability and diversification, they were often a source of additional volatility.

Let’s start by taking a look at what has changed.

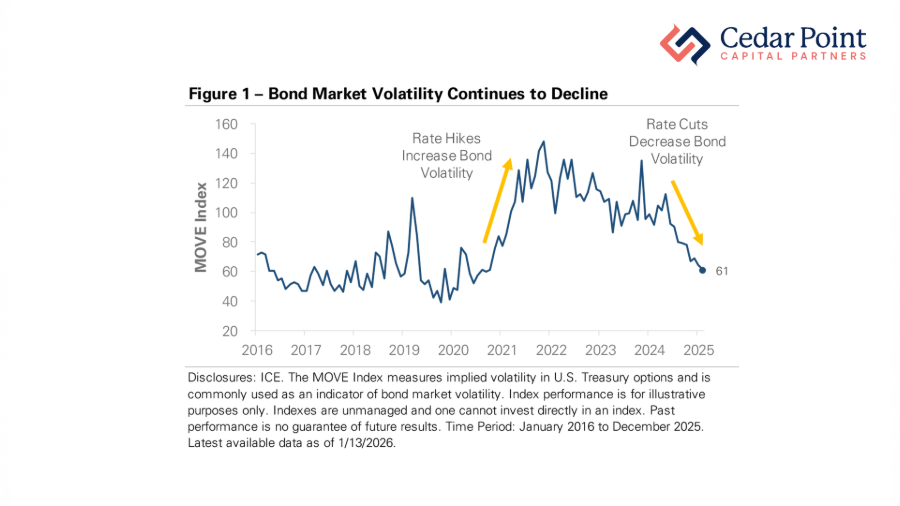

Here in Figure 1, we see the MOVE Index, which measures volatility in the US Treasury market. This metric is kind of like the bond-version of the more well known, VIX Index, which measures volatility in stocks. Accordingly, higher readings on the MOVE Index signal higher uncertainty in fixed income markets.

Bond volatility was relatively low throughout the 2010s, but that changed dramatically during the pandemic, and again in 2022, when the Federal Reserve raised interest rates at one of the fastest and steepest clips in modern history.

During that period, bond volatility spiked well above normal levels, and fixed income behaved more like a risk asset than a stabilizer.

Now, that picture has steadily improved over the past couple of years. Inflation has cooled and interest rate policy has become clearer. As of January 13, 2026, the MOVE Index sits just above 60, the lowest level since 2021. That’s a promising sign that the bond market is returning to a less volatile state.

Bond investment returns tell a similar story.

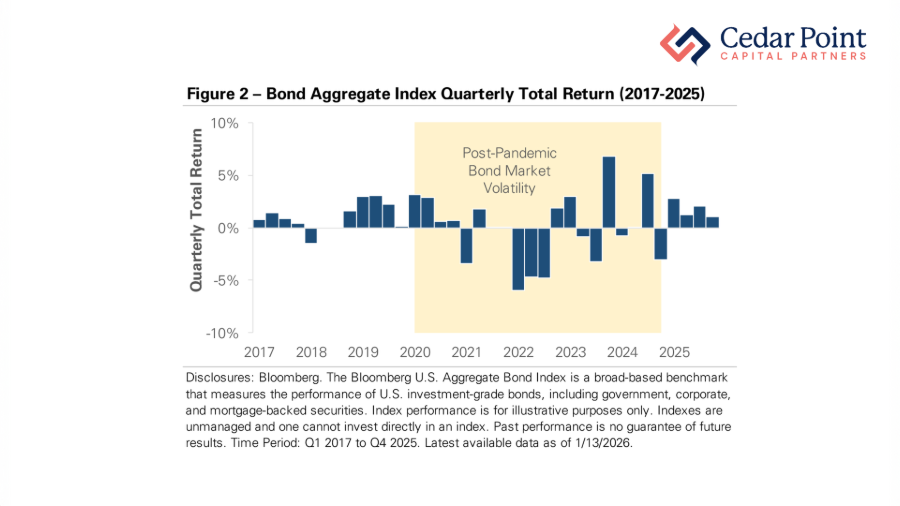

Figure 2 shows quarterly performance for the Bloomberg US Aggregate Bond Index, often used as a benchmark for the domestic investment-grade bond market. After a historically difficult stretch in 2021 and 2022, the market regained its footing in 2023.

Last year, investment-grade bonds delivered positive returns in every quarter and finished the year up more than 7 percent—the strongest annual result since 2020.

So, what does all this mean for your portfolio?

After several challenging years, bonds are offering higher yields in a lower-volatility environment. That combination supports a more familiar role for fixed income—providing income, diversification, and balance alongside equities.

That doesn’t mean volatility is gone for good, though. Economic data, inflation, and policy expectations will always matter. But as conditions normalize, this may be a good time to revisit your fixed income allocation and make sure it continues to support your long-term goals.

If you have any questions about this video or your portfolio, reach out and let’s start a conversation.

My name is Trent Von Ahsen, and I look forward to seeing you right here next month for our latest edition of Capital Insights.

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.