Capital Insights: Earnings and Expectations in Q1 2025

Jun 23 2025 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I'm Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to the June 2025 edition of Capital Insights.

This month, we're taking a closer look at corporate earnings and how they've been holding up in the face of economic and policy uncertainty.

The performance of the stock market really comes down to two things: earnings and valuations. Companies earn profits, and investors assign a value to those profits—often measured as a multiple of those earnings.

So far in 2025, investor attention has shifted toward earnings, especially with questions around tariffs and trade. That makes this a good time to check in on 1st quarter earnings, before the 2nd quarter earnings season kicks off in mid-July.

Despite all the concern earlier this year about trade policy and slowing growth, Q1 results were strong.

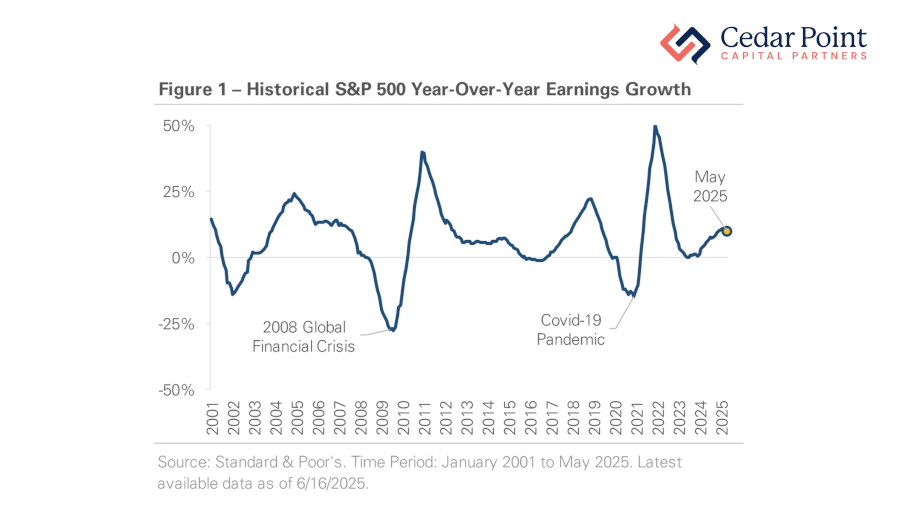

Looking here at Figure 1, we see the S&P 500's trailing 12-month earnings growth going back to 2001. This metric shows us the percentage increase – or decrease – in index constituent company profits over the last year, compared to the year prior.

In Q1, earnings grew by 10%, a sign that large US corporations continue to deliver solid results.

We can also look at year-over-year quarterly comparisons, which help strip out the impact of seasonal effects, like weather and holiday shopping.

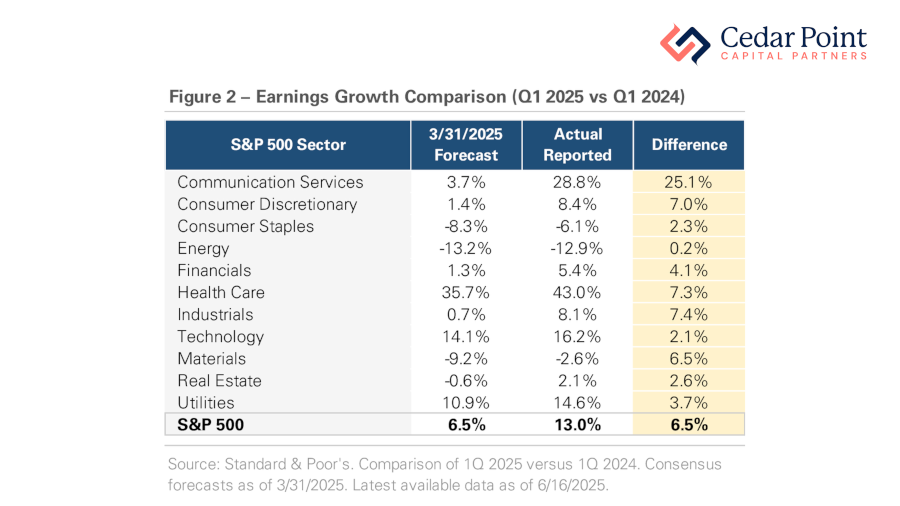

As we see in Figure 2, these comparisons look strong as well. Here, the table compares Q1 2025 earnings to the same quarter last year, broken down by sector. The table also shows average Wall Street analyst forecasts, or in other words, what was expected before these results came in. As you can see, actual earnings beat the forecasts across the board, with S&P 500 company earnings up 13%, year over year.

That broad-based strength suggests corporate America remains resilient, even as headlines raise questions.

It's also important to remember that Q1 earnings only reflect activity through March—before the new tariffs were announced in April. That means some of the real impact could still show up in later quarters.

In summary, 1st quarter earnings got 2025 off to a strong start, but the road ahead will depend on how companies respond to a shifting policy and economic environment.

If you have any questions about this video or your portfolio, reach out and let's start a conversation.

My name is Trent Von Ahsen, and I look forward to seeing you right here next month for our latest edition of Capital Insights.

Stay curious, stay mindful of your goals, and we'll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.