Capital Insights: The Hidden Power of a Raise

Feb 20 2026 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I’m Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to the February 2026 edition of Capital Insights.

This month, we’re changing things up a bit, zooming out, and looking at a very simple yet incredibly powerful question:

Why can two people with identical salaries end up with very different retirement lifestyles?

While possibly surprising to hear, one answer is – it often comes down to what happens after a raise.

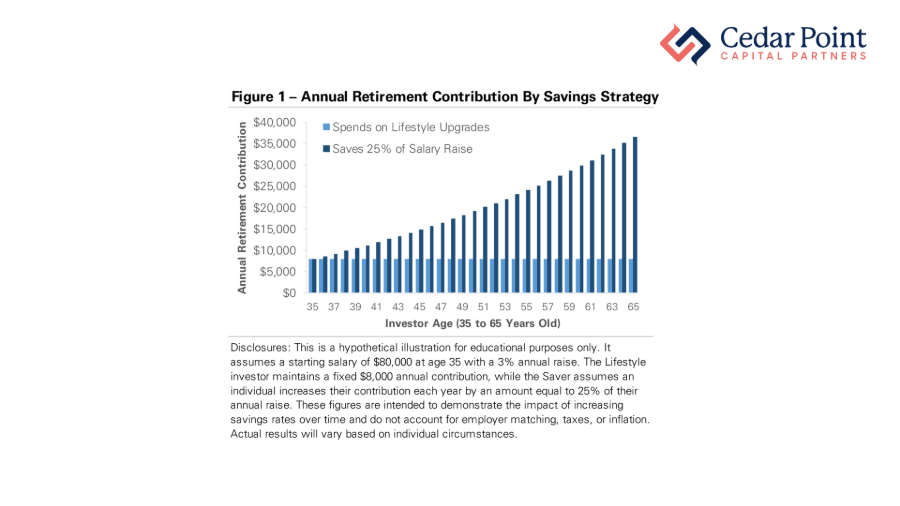

Let’s explore this a bit further – take a look at Figure 1.

Here, we see annual retirement contributions for two individuals. For illustrative purposes, assume both are 35 years old, earn $80,000, and receive 3% raises each year.

Let’s further assume they both start by contributing 10% of salary to retirement savings.

The key difference here? How they handle each raise.

One individual keeps their retirement contribution fixed at $8,000 and spends each marginal dollar they receive thereafter.

The other person saves a quarter of every 3% annual raise, while enjoying the remaining 75%.

At first, the gap is modest. But over time, those contributions begin to separate meaningfully. By their mid-60s, the saver is contributing more than four times the original annual amount, just by redirecting a portion of each raise.

So, what does that subtle shift in savings amount to over time?

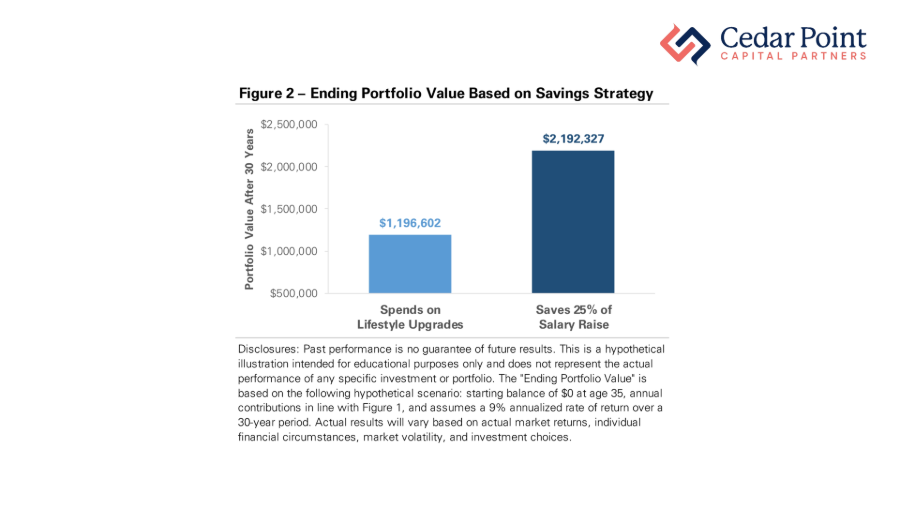

Moving to Figure 2, we see the respective terminal portfolio values at age 65 for our two individuals, assuming a hypothetical 9% annual rate of return over the period.

Over the preceding 30 years, the individual who spent every raise ends up with roughly $1.2 million, not bad. But our “saver” has accumulated an additional million dollars, thanks in part to the power of discipline, and more importantly to the power of compounding.

That additional balance means more than just a larger retirement account. It signifies greater financial flexibility in retirement, and the potential to leave a stronger legacy.

Here’s one additional consideration: The person who spends every raise isn’t just saving less. They’re likely also building a lifestyle with a higher cost of living over time, which, in turn, also requires a larger nest egg to sustain in retirement.

So, what does this all mean for you?

Financial progress isn’t measured by income alone. It’s measured by how intentionally you manage the surplus as you earn it. Enjoying your success and building future security aren’t mutually exclusive — but they do require a plan.

If you have any questions about this video or your portfolio, reach out and let’s start a conversation.

My name is Trent Von Ahsen, and I look forward to seeing you right here next month for our latest edition of Capital Insights.

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.