Capital Insights: Is History Repeating in Tech?

Jul 21 2025 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I’m Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to the July 2025 edition of Capital Insights.

This month, we’re looking at the ongoing surge in technological capital expenditures, and the lessons we may draw from a similar moment in the not-so-distant past.

Today, tech spending is accelerating at the fastest pace in decades, primarily driven by growth in Artificial Intelligence.

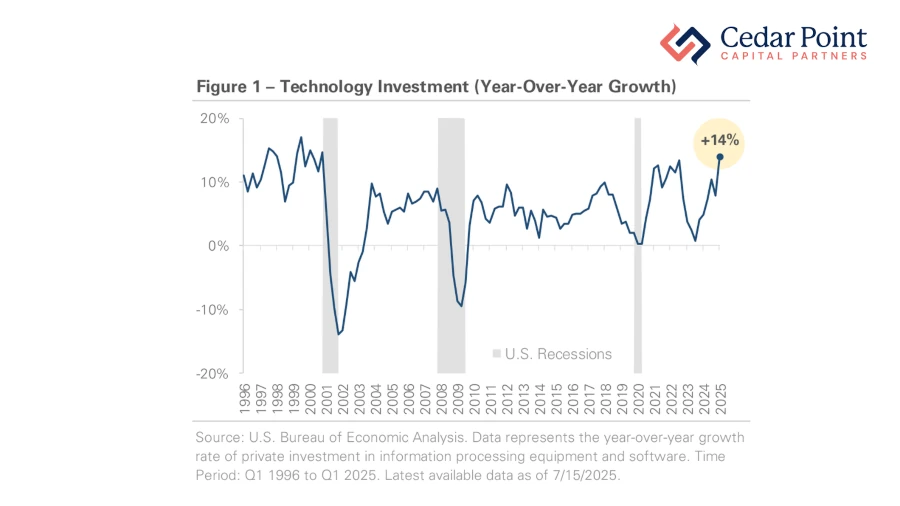

As we can see here in Figure 1, spending on IT equipment and software grew 14% year over year in Q1. That’s a level we haven’t seen since the dot-com boom of the late 1990s.

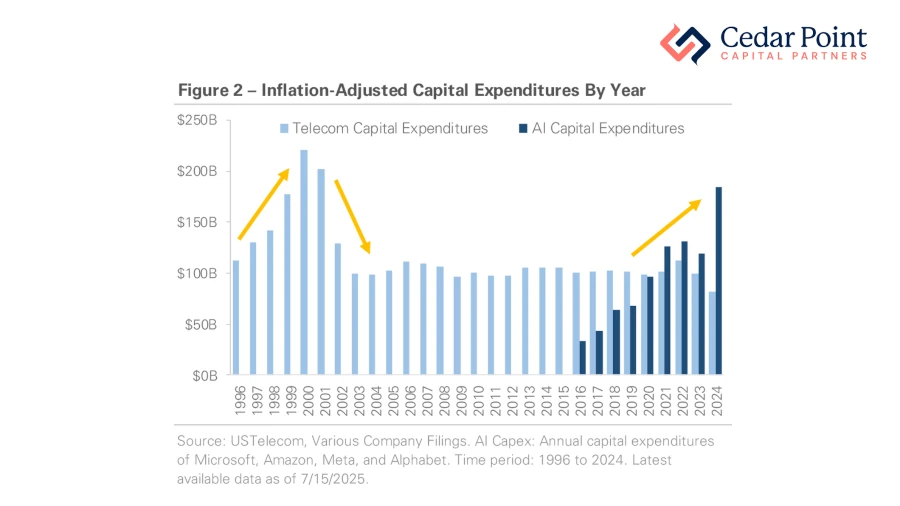

Back then, telecoms were pouring money into fiber and cell towers, helping launch the digital age as we know it. That ended with the bursting of the tech bubble in the early 2000s, with only a slight rebound by the middle of the decade.

Today a new wave of investment is underway, with AI leaders like Nvidia and Microsoft spending huge sums on chips, data centers and infrastructure.

Now as we look to Figure 2, compared to the late 90s boom, today’s tech expenditures are creating a new wave that could surpass even what we saw back then.

This investment surge has powered big market gains over the last two years. The S&P 500 tech sector is up 66%, while the “Magnificent 7” tech stocks – a group that includes Nvidia and Microsoft, along with juggernauts like Amazon, Meta and others - has risen a stunning 89% in the past 24 months. Even the broader S&P 500 Index is up 42% over this same period.

So, what can today’s investors learn from the last great technology capex ramp?

For starters, these types of booms tend to not last forever—growth cycles eventually return to more normalized spending levels, and that likely goes for our current cycle too.

Innovation remains a long-term strength of the U.S. economy—and being invested is one way to share in that progress.

Though, keep in mind, that while AI is on a hot streak right now, savvy investors remain diversified, disciplined, and stay prepared for whatever may come next.

If you have any questions about this video or your portfolio, reach out and let’s start a conversation.

My name is Trent Von Ahsen, and I look forward to seeing you right here next month for our latest edition of Capital Insights.

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.