Capital Insights: Interest Rate Cut Expectations [January 2024]

Jan 05 2024 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I’m Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to the new year and a new edition of Capital Insights!

This month, we’re taking a look at consumer expectations for lower interest rates, and how those expectations could impact the economy, whether they happen or not.

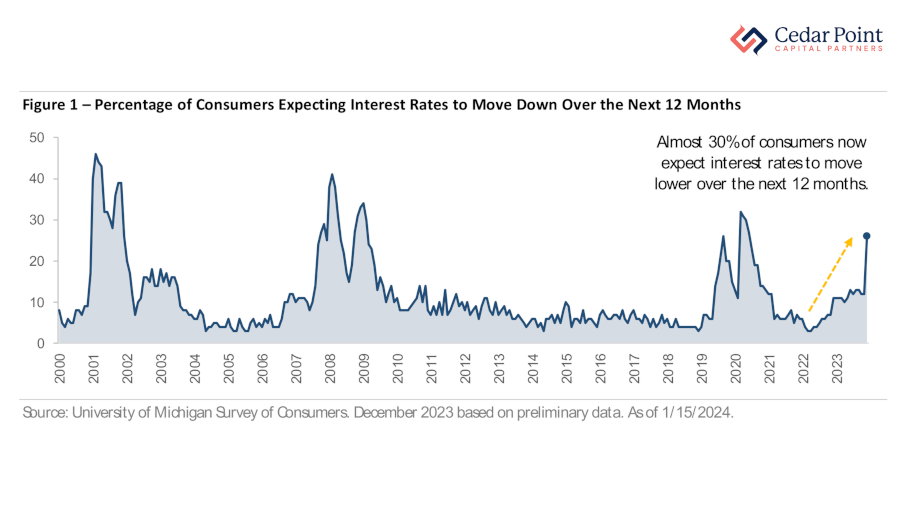

As we know, interest rates have been higher since 2022, when the Fed began its hiking cycle to help fight inflation following the pandemic. Today, with inflation back near its historic average, some believe the Fed will begin cutting rates in the months ahead. Take a look at Figure 1:

Courtesy of the University of Michigan’s Consumer Survey, in this chart – going back to the year 2000 – we see proportions of consumers expecting lower interest rates in the next 12 months. Nearly 30% of respondents this past December said they expect lower interest rates over the next year.

And that’s up from just 12% the month prior. It’s also the highest expectation level since 2020.

While the Fed’s decision on the interest rate path forward, remains to be seen, even the possibility of rate cuts could stimulate the economy. For instance, the housing market could pick back up if homebuyers believe they can refinance to a lower rate in the future. Likewise, businesses could decide to expand operations with lower financing costs on the horizon.

Investors should start reviewing their positioning now, for the prospect of lower interest rates, with the biggest opportunities in cash investments and fixed income positions.

If you have questions about this video or your portfolio, reach out and let’s start a conversation.

My name is Trent Von Ahsen, I look forward to seeing you right here next month for our latest edition of Capital Insights.

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.