Capital Insights: Is it Time to Revisit Small Caps?

Dec 18 2025 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I’m Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to our final edition of Capital Insights for 2025!

This month, we’re highlighting a development in the market that’s been easy to overlook, and that’s the growing momentum behind small-cap stocks.

It’s been a tough run for smaller companies in recent years. While large-cap stocks have driven the market, small-caps have lagged in the background.

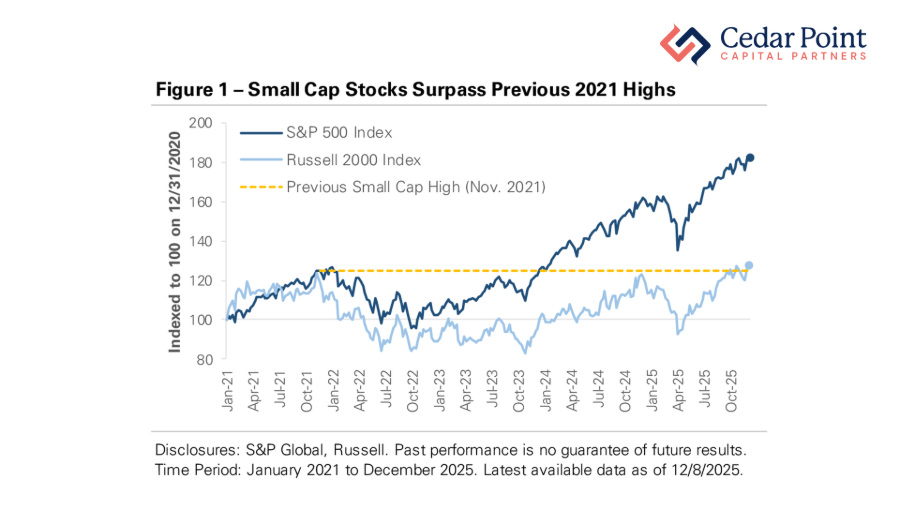

That dynamic is on display in Figure 1.

Here we are able to see the comparative performance over the past 5 years of the S&P 500 Index with the Russell 2000 Index, which tracks small-cap stocks. While the S&P 500 has hit nearly 100 new all-time highs over the past two years, the Russell 2000 remained stuck below its 2021 peak.

The drought ended this fall, when small-caps broke through to new highs, driven largely by expectations for Federal Reserve rate cuts.

Now, small-caps tend to be more sensitive to interest rates than their large-cap counterparts. That’s because these companies tend to rely more heavily on borrowing to fund growth, and higher rates can squeeze profit margins. When rates begin to fall, that pressure eases.

We’ve seen that play out in recent months. In the third quarter, small-caps gained 12%, compared to 8% for large-cap stocks, marking their strongest relative outperformance since early 2021.

This momentum has continued into the fourth quarter, all while small-caps continue to trade at a significant price-to-earnings discounts as compared to their large-cap peers. So, investors must be eager to allocate capital to this area of the market, right?

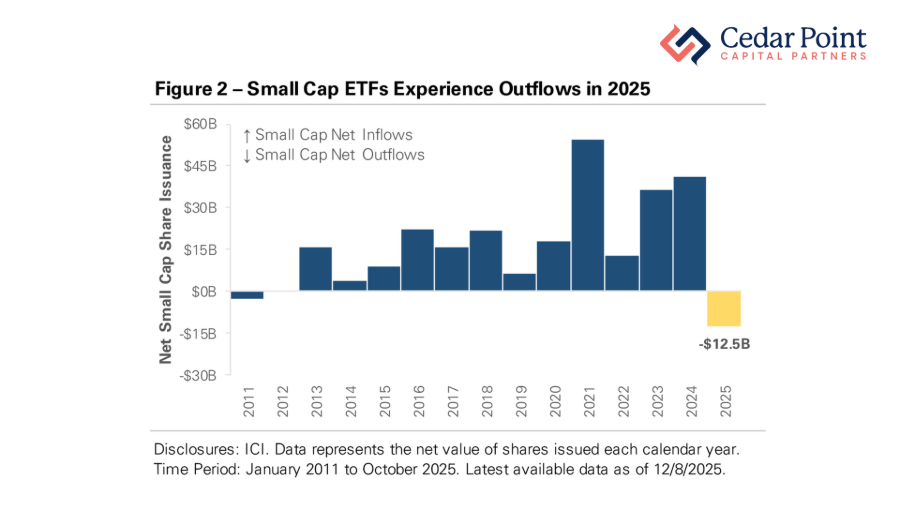

Not so fast, my friend. As we see in Figure 2, small-cap ETFs have actually posted net outflows this year, shedding roughly $12.5 billion through the end of this past October. If this holds through, it will mark the first year of net outflows since 2011.

The message is clear: small-cap stocks haven't just underperformed; they've been actively avoided. The combination of depressed valuations and persistent outflows suggests these stocks are not just undervalued, but genuinely unloved, and potentially under-owned.

So what does this mean for your portfolio?

If you’ve benefited from the S&P 500’s strong run, the breakout in small-caps is a reminder to step back and evaluate whether your allocation still reflects your long-term objectives.

Remember, the goal isn’t to time the market. It’s to manage portfolio drift.

Small-caps can offer diversification at a time when the S&P 500 Index is increasingly concentrated in a handful of tech stocks.

While they do tend to be more volatile, the investment case is strengthening—rate cuts favor smaller borrowers, valuations are more attractive, and investor positioning is light.

For investors with a long-term horizon, small-cap stocks may deserve consideration as we head into 2026.

If you have any questions about this video or how it impacts your portfolio, reach out and let’s start a conversation.

My name is Trent Von Ahsen, and I look forward to seeing you right here next month to kick off Capital Insights for 2026.

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.