Capital Insights: Making Your Retirement Savings Last

Aug 18 2025 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I'm Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to the August 2025 edition of Capital Insights.

This month, we're taking a step back and shifting our focus from investing and markets to retirement planning and creating a strategy for withdrawing your hard-earned retirement savings.

The transition from earning a paycheck to drawing from your portfolio is one of the biggest financial shifts you'll ever make—and the withdrawal strategy you choose can impact how long your money will last.

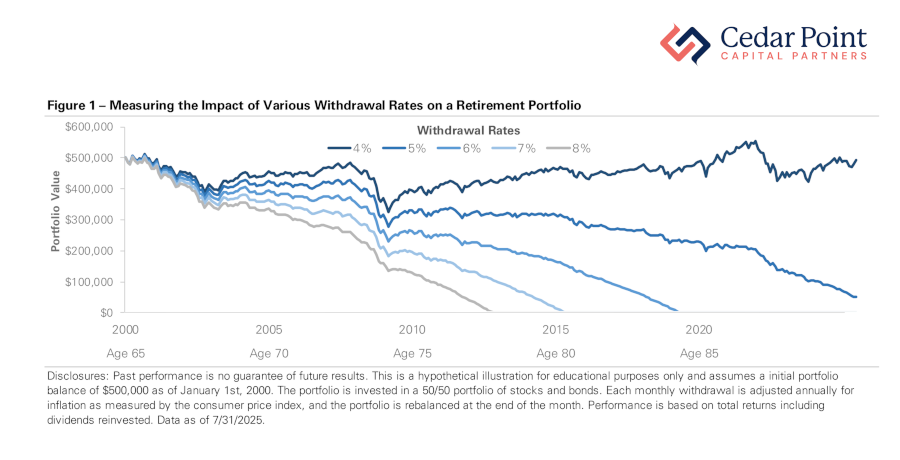

Taking a look at Figure 1, we see how different withdrawal rates, from 4% to 8%, would have affected a $500,000 portfolio—invested half in stocks and half in bonds—starting in the year 2000.

Notice how dramatically these paths diverge. While adjusting for inflation, withdrawing a fixed 7% or 8% annually would have completely depleted this portfolio within 15 years. Meanwhile, more conservative approaches held up remarkably well, even during historic market downturns.

The most striking fact of all? The 4% withdrawal strategy didn't just preserve the original portfolio—it actually allowed it to grow into retirement.

While there are certainly more variables to consider and no two situations are the same, the lesson here is clear: Aggressive withdrawal rates can exhaust even substantial portfolios quickly, while conservative withdrawal rates can work to extend their life.

But a withdrawal plan isn’t just about picking a percentage, as there’s no one-size-fits-all approach to this.

For some, a fixed withdrawal rate provides structure and predictability, while others may prefer more dynamic strategies.

One such strategy—the guardrails approach to retirement income—works to minimize potential retirement portfolio failure by reducing withdrawals during bear markets and increasing withdrawals when times are good.

The bottom line? Everyone's retirement journey looks different, which means your withdrawal strategy needs to be tailored to your circumstances, lifestyle, and long-term goals.

If you have any questions about this video or your portfolio, reach out and let’s start a conversation.

My name is Trent Von Ahsen, and I look forward to seeing you right here next month for our latest edition of Capital Insights.

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.