Capital Insights: Manufacturing Orders on the Rise [April 2024]

Apr 22 2024 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I’m Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to the April 2024 edition of Capital Insights!

This month, we’re taking a look at rising manufacturing orders and what they could signal for the economy in the months ahead.

Our main data point comes from a well-regarded survey by the Institute of Supply Management. ISM polls purchasing and supply managers monthly about the state of their businesses.

One of those poll questions asks if new orders have increased or decreased compared to the prior month. Readings above 50 indicate an expansion of new orders, while readings below 50 show contraction.

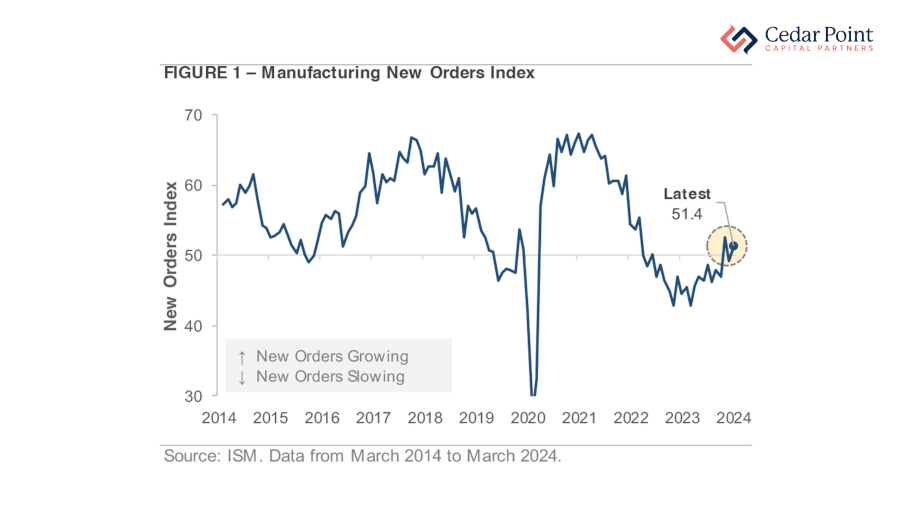

As you can see here in Figure 1, it has been a bumpy ride for the Orders index since it dropped to 30 at the start of the pandemic.

It rebounded quickly, but dropped back below 50 after the Federal Reserve began raising interest rates in 2022.

The index turned positive again in January, and now looks poised to continue its upward trend. This bodes well for our economy, because corporate earnings growth is typically stronger when new orders are higher.

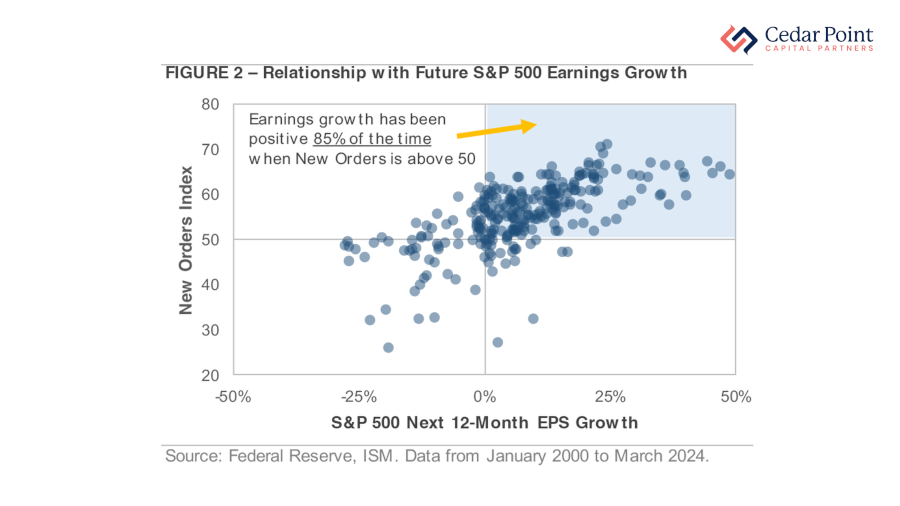

We can see that relationship mapped out in Figure 2.

Over the past two decades, earnings growth among S&P 500 companies has been positive 85% of the time whenever the new orders index is above 50.

If the index can stay positive for an extended period of time, it could signal good things for both the economy and corporate earnings.

If you have questions about this video or your financial plan, reach out and let’s start a conversation.

My name is Trent Von Ahsen, I look forward to seeing you right here next month for our latest edition of Capital Insights.

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.