Capital Insights: Recapping the S&P's Record Run [Dec. 2024]

Dec 18 2024 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I’m Trent Von Ahsen, Partner with Cedar Point Capital Partners. Welcome to the December 2024 edition of Capital Insights!

We’re closing out the year with a look at the record run of the S&P 500 index, and what that may mean as we flip the calendar ahead to 2025.

Now, the past two years have been remarkable for investors, with the S&P 500 posting back-to-back gains of over 20%.

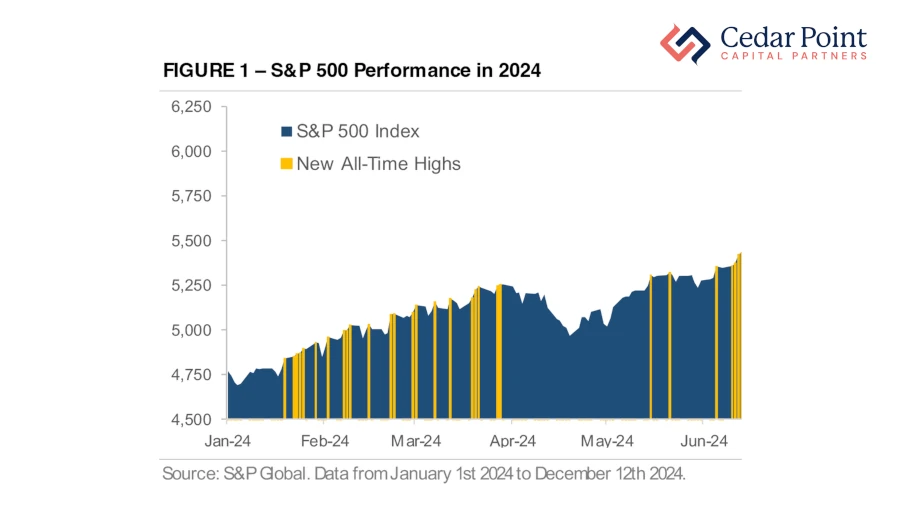

As we can see in Figure 1, the price movement of the index has hit more than 50 new all-time highs this year alone, highlighted here by the yellow shaded bars representing daily record closes.

This rally has been led by large-cap technology names like Nvidia, Meta and Amazon. And investors remain bullish about AI and prospects for a pro-business Trump administration.

The bond market has also echoed this confidence, with corporate high-yield credit spreads at levels not seen since May 2007.

The question on many minds now is whether that momentum can continue in the new year.

The S&P 500 index is currently trading at over 22 times forward earnings, which is historically expensive and approaching levels not seen outside of periods like the late-1990s tech boom and the immediate post-COVID recovery.

Investors have shown a willingness to pay higher multiples, but with valuations approaching extremes, earnings will no doubt play an important role in determining how much further markets can climb.

It’s common to see investors return their focus toward fundamentals as a bull market matures, and we’re likely to see that happen at some point in 2025.

One thing is certain: Companies will need to deliver on investors’ expectations to justify continued gains.

If you have questions about this video or your portfolio, reach out and let’s start a conversation.

My name is Trent Von Ahsen, I look forward to seeing you right here next month for the first Capital Insights of 2025!

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.