Capital Insights: What Tight Credit Spreads Signal About Risk

Sep 22 2025 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I'm Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to the September 2025 edition of Capital Insights.

This month, we’re taking a look at the bond market—specifically corporate bonds—and the trade-offs credit investors are facing today.

A key part of this conversation revolves around corporate credit spreads, which represent the premium rate companies have to pay to borrow, as compared to the United States government.

By all accounts, these spreads are the tightest we’ve been in decades.

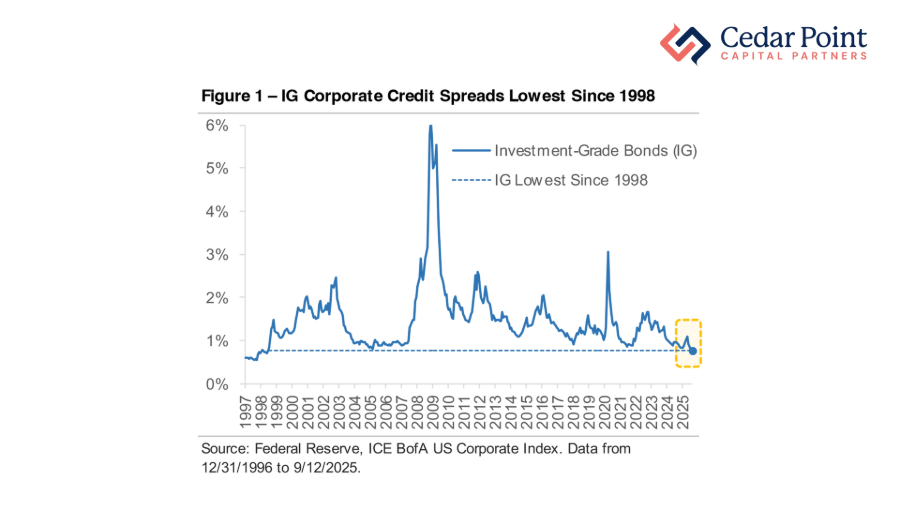

We can see this trend on display in Figure 1. As of September 12th, investment-grade corporate bond spreads are priced at just 0.77%, the lowest mark since 1998.

Historically, these risk spreads have been closer to 1.30%. In other words, investors aren’t demanding much premium for lending to the strongest companies in the market.

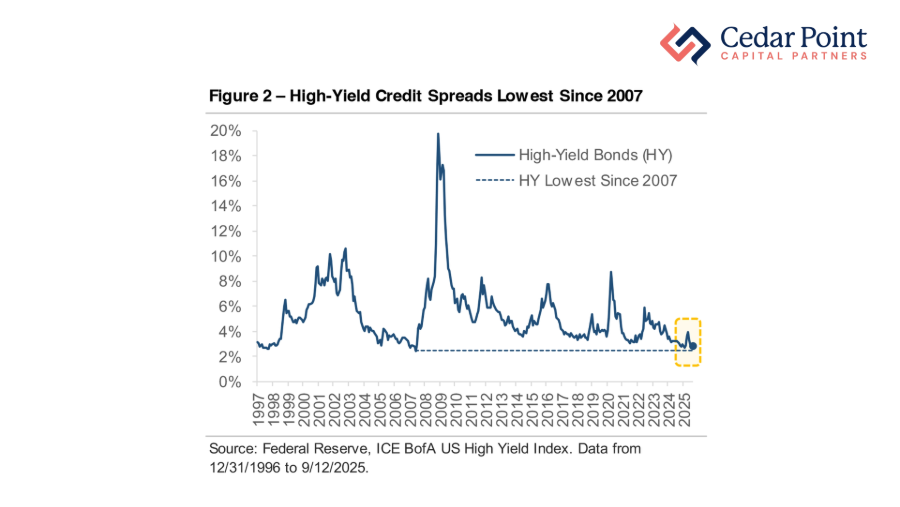

We can see the same story in high-yield bonds. Figure 2 shows current spreads there at 2.79%. Now, that’s the tightest spread we’ve seen since 2007, and going all the way back to 1996—well below that period’s long-term median high-yield spread of 4.59%

So why are corporate credit spreads this tight? Well, there are a few reasons:

- First, bond yields remain attractive in absolute terms. Investment-grade debt is currently paying around 4.8%, with high-yield debt yielding well over 7%.

- Second, corporate fundamentals and balance sheets look strong, with manageable debt loads and resilient earnings – while comparatively, there are real long-term concerns for the trajectory of government fiscal policy

- And finally, many investors believe the Fed will keep cutting rates, which makes today’s yields even more appealing to lock in.

While spreads are low by historical standards, extreme valuations don’t always correct quickly and often need a catalyst to normalize.

So, what could shift the balance of risk and change the market’s view on credit risk?

Well, two scenarios stand out:

- First, a slowdown in the economy, which would hurt corporate profits and cause the market to demand higher risk premiums on debt.

- Second, if companies take advantage of spreads and lock in additional debt at these comparatively low credit risk premium levels at scale, the boom in borrowing could add more supply to the bond market than demand can absorb.

The takeaway is that today’s bond market offers some compelling opportunities for income investors, but with limited margin for error and less cushion if conditions change. The market isn’t signaling danger, but it is not offering a margin of safety either. In this environment, it pays to be disciplined and keep a long-term perspective.

If you have any questions about this video or your portfolio, reach out and let’s start a conversation.

My name is Trent Von Ahsen, and I look forward to seeing you right here next month for our latest edition of Capital Insights.

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.