Capital Insights: Why Consumers Trust the Market But Not the Economy

Oct 23 2025 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I’m Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to the October 2025 edition of Capital Insights.

This month, we’re taking a look at consumer sentiment, specifically, an emerging divide—one that shows people are feeling optimistic about the stock market, but more cautious about the broader economy.

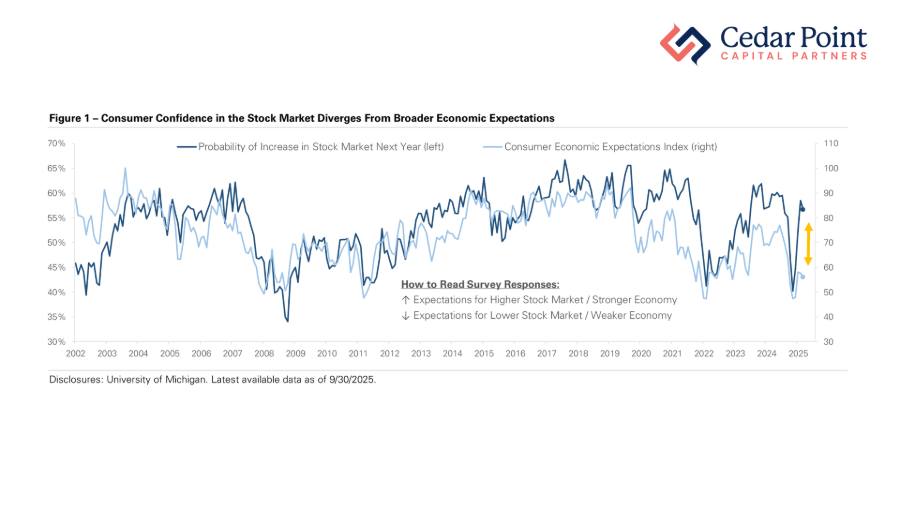

Now we can see that dynamic at play in Figure 1.

Here, the dark blue line tracks the percentage of consumers who believe the stock market will rise over the next year. The light blue line shows the University of Michigan’s Consumer Expectations Index. This measures outlooks for income, employment, and overall economic conditions.

Historically, these two lines have moved together: when consumers feel confident about markets, they typically feel confident about the economy, too. But that relationship has broken down in recent months.

Nearly 60% of consumers now expect the stock market to rise, even as the expectations index remains near levels we last saw during the 2020 pandemic and the 2008 financial crisis.

So why the disconnect?

It really boils down to perception. Consumers have watched the S&P 500 Index’s record run this year, including 20 new all-time highs driven by massive AI related investments.

Many households have benefitted from those gains through their retirement accounts, and it’s boosted confidence in markets.

Closer to home, however, things are less certain. Housing affordability remains an issue, and inflation continues to pressure budgets, especially on essentials.

Meanwhile, the labor market has cooled considerably, making future employment prospects less certain.

It’s rare to see such a wide gap between how consumers view markets and the economy, and it highlights a key tension right now: Tech optimism is powering markets higher, but weak consumer sentiment could eventually weigh on spending.

Confidence can fuel momentum in markets, but the foundation of long-term growth still depends on household stability and spending power. It’s a relationship we’ll be watching closely in the months ahead.

If you have any questions about this video or your portfolio, reach out and let’s start a conversation.

My name is Trent Von Ahsen, and I look forward to seeing you right here next month for our latest edition of Capital Insights.

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.