Why Time in the Market is Better Than Timing the Market

Jan 18 2024 | Back to Blog List

You’ve probably heard the phrase, “time in the market is better than timing the market”—and maybe even from us. Most investors intuitively understand its wisdom, which is why we like it, but we also know putting your faith in time when markets are headed down can be another thing entirely.

The good thing about evidence-based investing, a philosophy Cedar Point Capital Partners was founded on, is that you don’t have to just believe in the approach. There are reams of research and historical data—evidence—that prove time works, and give us the confidence to build entire investment strategies on its basis for our clients.

The good thing about evidence-based investing, a philosophy Cedar Point Capital Partners was founded on, is that you don’t have to just believe in the approach. There are reams of research and historical data—evidence—that prove time works, and give us the confidence to build entire investment strategies on its basis for our clients.

We wanted to break down some of that research and data, so you can see for yourself why time in the market generally wins, and how you can use that knowledge to stay calm (and fully invested) during the next big market calamity.

The Power of Compounding

Perhaps the best thing about putting time in the market versus timing a trade is that it requires a fraction of the effort as an investor.

Generally speaking, historical data shows significant appreciation of broad financial assets—think stocks, bonds, bills—when held over the long-term. Over time (measured here in generations, not years) the law of compounding takes effect, creating exponential growth. That’s how small investments become nest eggs, and larger investments become legacies.

Timing a trade—buying the dip or trying to sell at the peak—requires much more thought and deliberation and analysis. It’s a lot of work, for a likely worse outcome (more on that in a minute).

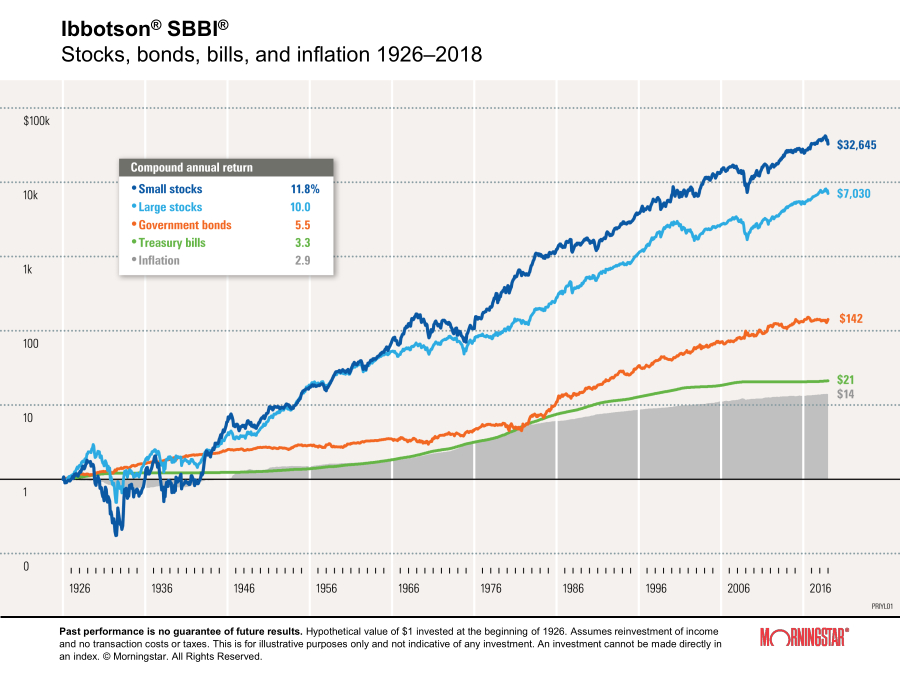

You can see the power of compounding in effect when looking at the hypothetical growth of a dollar invested in various assets over time. Here's a chart from Morningstar:

With a time horizon of a century (!!) like we see here, every investment beat inflation through compounded returns (assuming reinvestment of earnings/gains). The investments with the highest long-term annualized growth rates—small cap & large cap stocks—did so despite experiencing tremendous financial shocks and significant losses at several points in the timeline.

The Fallacy of the Perfectly Timed Trade

“OK,” you might say, “I understand more time in the market gives me the opportunity for compound growth. But, surely, making a well-researched and well-timed trade during moments of crisis can help preserve my capital, so I have more to invest when the time is right.”

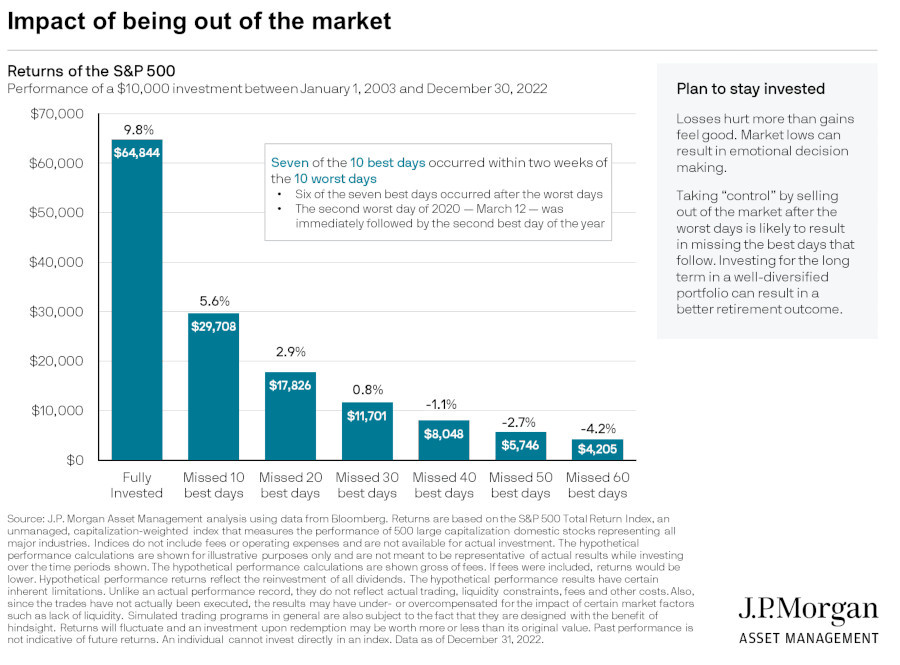

It’s a nice idea, and one that brokers and traders love to sell, but you should know the historical record says otherwise. Take this chart from JP Morgan:

It notes that the S&P 500 Index’s 10 best days from 2003-2022 occurred within two weeks of the 10 worst days. Six of the seven best days occurred after the worst days. If you are jumping out of the market on the worst days, you could also be missing out on the incredible rebounds that fuel compound gains in your portfolio.

With a hypothetical $10,000 investment in an S&P 500 Index fund, the fully invested portfolio would have enjoyed an annualized return of 9.8%. Missing just 10 of the best days in that 20 year span would have cut the portfolio return to 5.6%—and dropped its end value by almost $40,000.

Missing only the best 30 days (of the more than 5,000 trading days in this time series) reduces the portfolio investment performance to less than 1% per year, and it goes down from there.

No one knows if that big weeklong sell-off is the start of a prolonged bear market or a small detour on the way to a new market high. By selling and waiting for the “right time” to get back in, you could be missing some of the market’s best days, and that means less compounding and lower growth over the long-term.

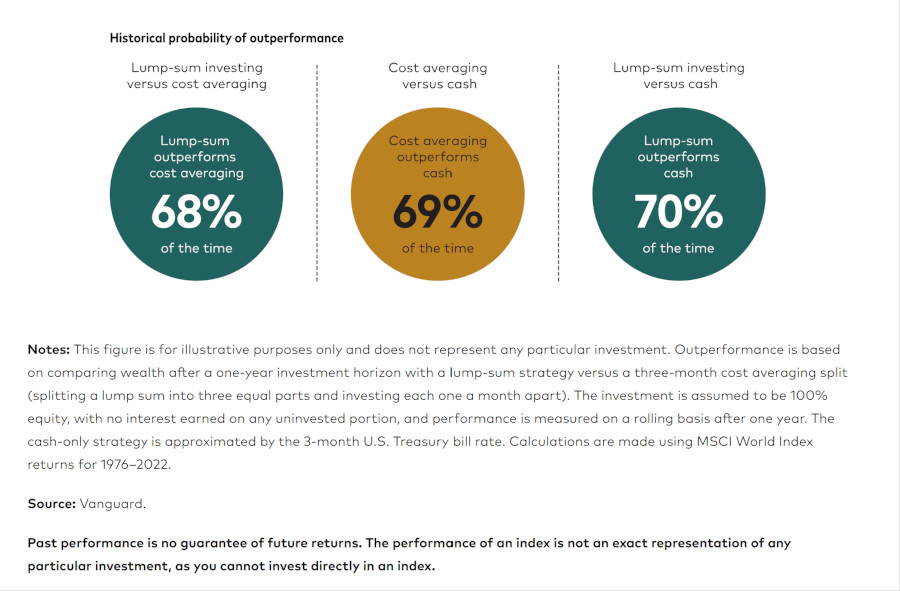

Interestingly enough, this chart also explains why lump-sum investing generally beats cost averaging approaches. While investing money at small, consistent intervals may smooth out volatility and turbulence, you’re also keeping a percentage of your funds from working for you in the market. A study from Vanguard confirms this, finding that lump-sum investing outperforms cost averaging strategies more than two-thirds of the time, with a growing advantage as the time period gets longer:

Of course, both approaches outperform sitting on cash and trying to pick your spot, so don’t wait.

A Closing Note

This Financial Insights post used historical data to explain precisely why time in the market is better than timing the market, but it also used some big assumptions and high-risk examples, like investing solely in small cap stocks for a century. While long-term growth is the key objective for most investors, there are many other considerations that go into the evidence-based strategies we build for our wealth management clients, from capital preservation to tax sensitivities.

Time in the market is important, but a holistic investment strategy that takes into account all of your dimensions is perhaps the most critical piece of successful financial planning.

If you’re ready to quit wasting time and put your money to work, give us a call and let’s grow together.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.